We all respond to a crisis in different ways. When faced with uncertainty, we gravitate to behaviors over which we having some control. In this pandemic, online buying is one of them.

While it meets the basic needs of delivering essential goods, it also meets the psychological needs of autonomy, providing for family and “retail therapy.”

Because it plays an important role in how we all have had to pivot in the pandemic, our demands on it have increased. And smart marketers will recognize this and adjust, accordingly.

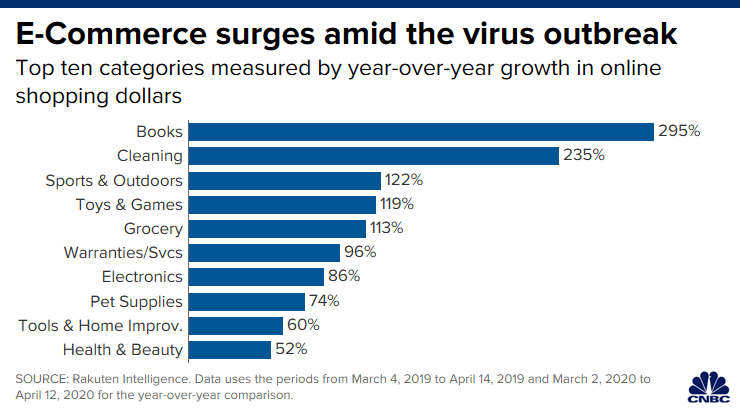

Here are 30 online buying facts that show how we all have had to pivot in this pandemic. And it starts with the top ten categories where online buying has increased.

30 pivotal online buying facts

- $1 of every $5 spent by U.S. consumers came from online orders in the 2nd Quarter 2020.

- 97% year over year increase in Walmart’s e-commerce sales in 2nd Quarter 2020.

- 91% of shoppers miss shopping in stores, but only 5% plan to try a product in-store in the next six months.

- 90% prefer home delivery over a store visit in the next six months.

- 85% of shoppers have significantly increased curbside pickup since the pandemic began,

- Nike’s digital sales grew 82% year-on-year between June and August

- 80% of shoppers expect to increase curbside pickup over the next six months.

- 80% of shoppers say digital communications with store associates over the next six months are “likely” or “very likely.”

- E-commerce sales are up 76% ($73.0B) YoY in June 2020, followed by 55% ($66.3B) in July. They are slowing somewhat with stores reopening.

- 71% want to know product availability before purchasing online or in-store.

- Even after COVID-19 effects subside, 68% of U.S. shoppers expect to continue buying essential goods online.

- 60% of shoppers are prioritizing the purchase of essential items when shopping online.

- 64% want a mobile and contactless pickup or check-in options.

- There has been a 50% decrease in consumer discretionary spending during the pandemic even though online buying is on the rise.

- 45% of shoppers care less about Black Friday this year than they did in previous years

- Online spend with U.S. retailers grew 44.4%, to a total of $200.72B spent in 1n\

- 36% of people now shop online weekly (+28% from pre-COVID-19).

- 42% of online buying merchants suspended their in-store return policies.

- 40% relaxed returns to encourage sales during this period. E-commerce giant Amazon at one point maintained a generous 90-day return program.

- 40% year over year sales growth for Amazon in the most recent quarter.

- On balance, there’s more of a preference for in-store (39%) over online (26%).

- Europe saw a 35% rise in e-commerce app installs during the peak of the coronavirus outbreak

- In the UK, 35% of all online purchases during the lockdown period were made via Amazon,

- 32% year over year increase in online buying between April and June 2020 to $212 billion.

- 30% increase in e-commerce spending from the beginning of March through mid-April compared with the same period last year, according to Rakuten Intelligence.

- 29% shop more online than in person.

- 18% growth in e-commerce sales is expected for 2020 and a 14% decrease is expected for brick and mortar sales according to eMarketer.

- 12% of people said in April 2020 that they had just purchased fresh produce online for the very first time.

- 10.5% of all grocery spending was online pre-pandemic, according to Trends. That figure rose to 14.5% in February of 2020 and surged to 27.9% in the March/April period.

- Only 10% of shoppers said they no longer shopped in-store at the height of the pandemic.

Do these facts show you the way online buying meets our practical and psychological needs? Is your business evolving as our behaviors change?